BUSINESS

-

Jun- 2023 -3 June

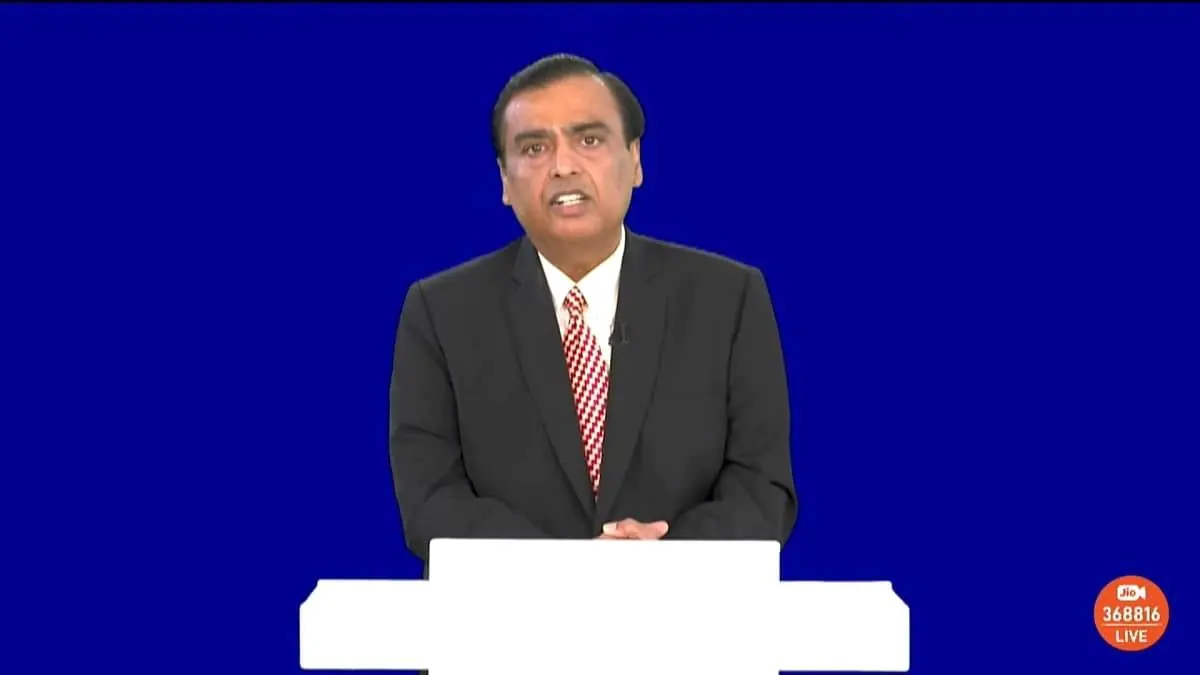

Mukesh Ambani firm invested Rs 50 crore in EV firm, it will be valued at Rs 2895 crore if…

Altigreen Propulsion Labs Pvt Ltd, a company backed by Mukesh Ambani’s Reliance, is mulling raising Rs 700 crore. The company manufactures electric cargo three-wheelers. The company counts Mukesh Ambani as its backers. If the company gets investment at the valuation it seeks, it will come to be around 350 million dollars (Rs 2895 crore). The company is hoping to wrap the fundraising exercise by July. The company was founded in 2013 by Amitabh Saran, who is also his CEO. The company’s annual production is 55000. The company raised Rs 300 crore last year. Mukesh Ambani’s Reliance New Energy Limited was among the investors. The company last year entered an agreement with Altigreen to invest Rs 50.16 crore. The company has…

Read More » -

2 June

Anger as Amazon avoids millions of pounds of corporation tax thanks to Rishi Sunak scheme

Critics have lashed out after it emerged Amazon’s main UK division paid no corporation tax for the second year in a row. The online giant picked up a £7.7million tax credit as it benefited from a Government scheme rewarding its investment in infrastructure – including its use of robots. It has sparked claims it has been able to undercut smaller businesses. New accounts filed at Companies House reveal Amazon UK Services was spared paying corporation tax thanks to Mr Sunak’s “super-deduction” scheme, brought in while he was Chancellor. It rewards businesses that plough cash into helping them expand, but detractors say Amazon would have done so anyway without the incentives. Paul Monaghan, chief executive of the Fair Tax Foundation, fumed:…

Read More » -

2 June

New Trouble For Adani As Deloitte Agrees With Some Of Hindenburg’s Claims Against The Conglomerate

At a time when Adani Group shares are enjoying a green phase after bleeding heavily in the first quarter of the year after Hindenburg Research’s report rattled them, fresh trouble seems to be brewing for the Gautam Adani led conglomerate. bloomberg© Provided by Indiatimes Audit giant Deloitte, which is Adani Ports & Special Economic Zone’s auditor, has sounded a note of caution over insufficient disclosures around the company’s transactions with certain entities. This returns the spotlight to the allegations made by short seller Hindenburg Research on Gautam Adani’s empire. For the unversed, Adani Ports is also touted as the Adani group’s ‘crown jewel’. Deloitte Haskins & Sells LLP raised concerns this week over the Adani Group Company’s transactions with three entities, which the company said were unrelated parties. But the auditor said it…

Read More » -

May- 2023 -27 May

Dollar set for third week of gains as US debt talks loom large

The dollar eased on Friday but remained on track for a third straight weekly gain, as markets raised bets on higher-for-longer interest rates to curb sticky inflation and nervously awaited a resolution to last-ditch U.S. debt ceiling talks. Apparent progress on Thursday in talks between President Joe Biden and top congressional Republican Kevin McCarthy helped ease jitters, but markets remained on edge at any risk of a default ahead of a long bank holiday weekend in the U.S. “Monday is a bank holiday in the U.S. so market participants will have to wait until Tuesday 30th May to trade positions again so there is a strong belief that Washington needs to make a deal happen today,” currency analysts at MUFG…

Read More » -

27 May

Wipro top brass take pay cut, Premji’s salary halves

Wipro’s modest performance last year has resulted in a big pay cut for chairman Rishad Premji. According to the company’s annual report for the year that was released on Thursday, Premji took home $951,353 during the year, almost 50% lower than the $1.8 million he drew the year before. His salary included a basic component of $861,620, long-term benefits of $74,343, and other allowances of $15,390. He received no commission. Premji is entitled to a commission at the rate of 0.35% on incremental consolidated net profit of Wipro over the previous fiscal year. However, the report said, since incremental consolidated net profit for the year was negative, no commission was payable to him. CEO Thierry Delaporte’s salary dropped marginally to…

Read More » -

25 May

Mukesh Ambani, Isha Ambani firm sacks 1000 workers after spending Rs 2850 crore, here’s what happened

Jiomart, Mukesh Ambani’s wholesale online platform, has laid off 1000 employees days after it acquired Metro Cash and Carry. This is just the beginning of the drive which will see nearly two-third of the company’s 15000 workforce reduced. The layoffs include nearly 500 corporate employees. It has put hundreds of employees on a ‘performance improvement plan’ as it plans a larger round of layoffs, reported ET. According to the paper, the rest of the employees’ salaries had been lowered. They have been put on a variable pay structure. The company attempts to replace distributors for grocery stories. The decision has reportedly been taken as Metro’s permanent workforce of 3500 employees will result in overlap of several roles. The company is…

Read More » -

23 May

Adani Enterprises shares surge by over 46 pc in five days

The value of Adani Enterprises Ltd shares increased from Rs 1886 on May 17 to Rs 2759 today Adani Group The shares of Adani Enterprises Ltd, the flagship company of Adani Group, have experienced a remarkable surge of over 46 percent in the last five days. This surge in share prices came after a recent finding by the Supreme Court-appointed committee, which has provided a positive outlook for investors. The surge in Adani Enterprises shares began on Friday when a committee led by retired judge A.M. Sapre, assigned to investigate the Adani-Hindenburg controversy, disclosed its findings. The committee, after considering explanations provided by the Securities and Exchange Board of India (SEBI) and analyzing empirical data, stated that there was no…

Read More » -

20 May

India’s super rich will double to 1.6 million by 2027: Knight Frank

India’s billionaires are expected to grow to 195 by 2027, says a Knight Frank wealth report. India has new opportunities in manufacturing, infrastructure, tech and more, which will aid wealth creation, says Shishir Baijal, CMD of Knight Frank India. Even as the number of HNIs and billionaires in India grew in 2022 from the year before, the number of UHNIs fell by 7.5%. As of 2022, India is home to 797,714 high-net-worth individuals (HNIs), or those whose asset value is at $1 million or more. Such individuals will double in number – growing at a massive 108% in the next five years to 1.7 million, estimates a report by Knight Frank. India’s ultra-high-net-worth individuals (UHNWIs), with net worth over $30…

Read More » -

18 May

Sanjiv Kapoor joins Saudi Arabia’s SAUDIA after quitting Jet Airways as CEO-designate, says report

Sanjiv Kapoor, who recently resigned from the post of CEO-designate of cash-strapped carrier Jet Airways, has joined Jeddah-based Saudia as the advisor to its Director General Ibrahim Al-Omar. In an article in The Economic Times, Kapoor confirmed his appointment. SAUDIA, one of the two major airlines of Saudi Arabia, has been working on its expansion plan. On March 21, SAUDIA declared that it is working to add 25 new destinations in 2023 on the SAUDIA Group Network. It also added that it would buy 39 wide-bodied 787 Dreamliner planes from Boeing in line with its expansion plans. Last month, Kapoor resigned from his post of CEO-designate of Jet Airways. He joined Jet Airways as their Chief Executive Officer (CEO) on April 4,…

Read More » -

18 May

Air India Express brings 280 pilots, 250 crew onboard

Air India Express, the low-cost international carrier, has hired over 280 pilots and 250 cabin crew during a recent recruitment drive conducted across Mumbai, Delhi and Bengaluru. As per the airline, about 300 pilots participated in the selection process conducted during the drive, news agency PTI reported. Air India Express is owned by Tata Group, which acquired the airline along with the full-service carrier Air India in late January last year. Apart from Air India and Air India Express, the Group also owns domestic budget carrier AirAsia India as well as a 51 per cent stake in its joint venture airline with Singapore Airlines, Vistara. While Vistara is in the process of merging with Air India, AirAsia India is being integrated with…

Read More »