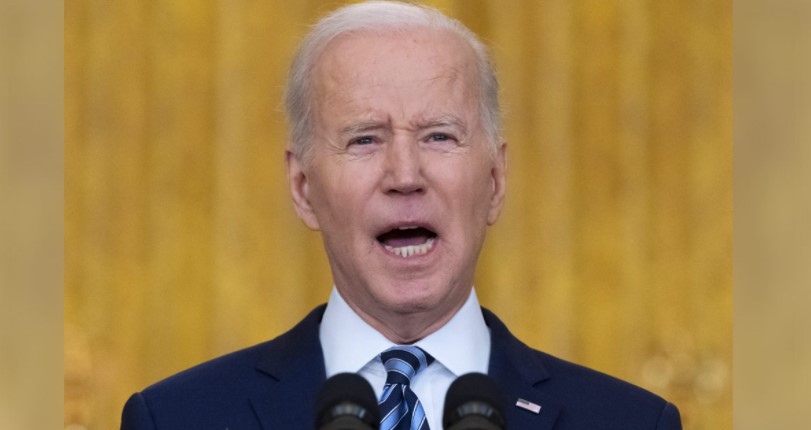

Biden’s student-loan forgiveness could be delayed next week as lawsuits continue to mount. Here’s where the cases stand.

- Biden’s student-loan forgiveness is facing at least four lawsuits from conservative groups.

- A federal judge will hear arguments on one of them next week and decide whether to pause the relief.

Conservatives aren’t happy with President Joe Biden’s student-loan forgiveness — and some of them have taken the policy to court.

The administration faces at least four major lawsuits, and a federal judge will hear oral arguments for one led by Republican states next week. They could grant the states’ request to pause on Biden’s debt-relief plan — either way, despite a promised application coming out this month, the judge said no debt would be forgiven before October 17.

At the end of August, Biden announced up to $20,000 in debt relief for federal borrowers making under $125,000 a year. It was a long-anticipated announcement, given the relief was something he promised on the campaign trail and was a policy Democratic lawmakers had been pushing him to enact ever since. While some Democrats wanted the president to go even bigger on the loan forgiveness, they still lauded the policy as a significant first step toward addressing the $1.7 trillion student debt crisis.

But many Republicans felt otherwise. In the months leading up to Biden’s announcement, they slammed the broad debt relief as unfair, costly, and illegal — and they threatened to pursue legal action should the policy be implemented. Leading Republican on the House education committee Virginia Foxx, along with other GOP lawmakers, support their efforts.

“The Biden administration’s student loan bailout should be squashed by the heel of the law—its illegality must not be ignored,” Foxx said in a recent statement. “Millions of hardworking taxpayers will be forced to shoulder the financial burden of this scheme if it is not stopped.”

The White House has maintained it has the authority to enact this one-time broad relief under the HEROES Act of 2003, which gives the Education Secretary the authority to modify or waive student-loan balances in connection with a national emergency, like COVID-19. But the groups pursuing legal action said the policy is an overreach of that authority, hurts states’ revenues, and unconstitutionally advances racial equity — and should the cases advance in court, the timeline for debt relief could be jeopardized.

A White House administration official told Insider that “we’re charging full speed ahead in getting relief to the borrowers who need it most.”

“We’ve got a dedicated team at the Department of Education working closely with a team here at the White House to get the program up and running,” the official added. “The sign-up period for debt relief will open up this month. It’ll be a short, simple application. We’ve also started communicating directly with borrowers on what to expect in the coming weeks. We’ll have more to share in the coming days.”

For now, borrowers can expect an application for student-loan forgiveness to become live in October, and during a Wednesday press call, an administration official said the lawsuits should not impact the release date of the application.

Where the lawsuits currently stand

Pacific Legal Foundation. On September 27, the Pacific Legal Foundation — a conservative nonprofit legal organization — helmed the first major lawsuit against Biden’s debt relief. The plaintiff is a student-loan borrower, Frank Garrison, who is a public interest attorney eligible for the Public Service Loan Forgiveness (PSLF) program, and he argued that automatic debt relief would cause him to incur a tax bill he would not have received otherwise.

The White House quickly countered that argument by saying that student-loan borrowers have the ability to opt out of debt relief if they do not want it, for any reason. “The claim is baseless for a simple reason: No one will be forced to get debt relief. Anyone who does not want debt relief can choose to opt out,” Abdullah Hasan, White House assistant press secretary, previously said in a statement to Insider. The group said it will amend its complaint to continue to challenge the loan forgiveness.

6 Republican-led states. On September 29, six Republican-led states filed another lawsuit challenging Biden’s debt relief. Arkansas, South Carolina, Iowa, Kansas, Nebraska, and Missouri — the latter of which the lawsuit was filed in — argued that the debt cancellation would hurt the states’ revenues, and they said the authority does not exist under the HEROES Act to carry out this policy.

They also argued that the plan would hurt MOHELA, a student-loan company based in Missouri, which is facing a “number of ongoing financial harms” to its business. The case referred specifically to the Federal Family Education Loan (FFEL) program, a privately held loan guaranteed by the government that would not qualify for Biden’s debt relief without consolidation into the direct-loan program.

The White House responded to this lawsuit by updating its guidance on eligibility for student-debt relief and saying that FFEL borrowers will not be able to consolidate there loans, and therefore, will not be able to qualify for the relief. However, a judge is hearing oral arguments on the case on October 12 to decide whether to grant the states a pause on the debt-relief plan and has already affirmed that no student debt will be canceled before October 17.

Arizona’s attorney general. On September 30, Arizona Attorney General Mark Brnovich filed a lawsuit against Biden’s student-loan forgiveness, arguing that it will harm the state by making it harder to recruit lawyers through Public Service Loan Forgiveness and cutting state tax revenues. Brnovich previously said that people were “prematurely” celebrating the debt relief and foreshadowed his intention to pursue legal action. The lawsuit now heads to the Biden administration to confirm receipt of the legal action.

Wisconsin Institute for Law and Liberty. Most recently, on October 4, the Wisconsin Institute for Law and Liberty (WILL) — a conservative law firm — filed a federal lawsuit on behalf of the Brown County Taxpayers Association challenging Biden’s debt relief plan. The group argued that Biden’s plan has an “improper racial motive” by seeking to help Black borrowers and advance racial equity and said it violates the constitutional rights of equal protection and separation of powers, by enacting the forgiveness without Congressional approval.

On Thursday, a federal judge struck down the group’s argument and declined to grant them a pause on the debt-relief. But he did say a future administration could recollect the forgiven debts should a court find the authority does not exist to cancel student debt broadly.