Biden, McCarthy reach tentative deal to raise US debt ceiling

Deal raises debt limit for two years while capping some spending, but uncertainty remains on whether it can pass Congress.

US President Joe Biden and House Speaker Kevin McCarthy have reached a tentative deal to raise the federal government’s $3.4 trillion debt ceiling days ahead of a deadline to avert a potentially catastrophic default.

The agreement on Saturday would raise the debt limit for two years while capping spending over that time, but risks angering both Democratic and Republican sides with the concessions made to reach it.

Support from both parties will be needed to win congressional approval next week before the United States runs out of money to pay its debts on June 5.

The Democratic president and the Republican speaker reached the “agreement in principle” on Saturday after they held a 90-minute telephone call.

“The agreement represents a compromise, which means not everyone gets what they want,” Biden said in a statement late on Saturday. “That’s the responsibility of governing,” he said.

The president called the agreement “good news for the American people because it prevents what could have been a catastrophic default and would have led to an economic recession, retirement accounts devastated, and millions of jobs lost”.

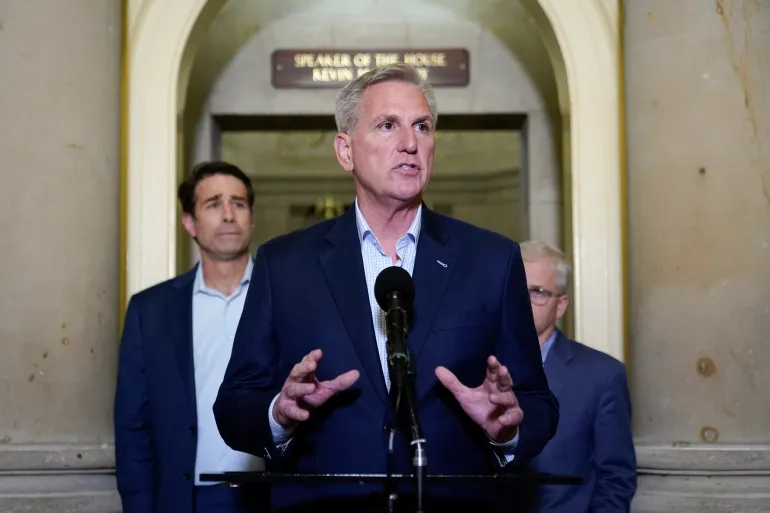

McCarthy in brief remarks at the Capitol, said that “we still have a lot of work to do”. But the Republican speaker said: “I believe this is an agreement in principle that’s worthy of the American people.”

He added that he expects to finish writing the bill on Sunday, then speak to Biden and have a vote on the deal on Wednesday.

Central to the package is a two-year budget deal that would hold spending flat for 2024 and impose limits for 2025 in exchange for raising the debt limit for two years, pushing the volatile political issue past the next presidential election.

The agreement would also claw back unused COVID-19 funds, speed up the permitting process for some energy projects and include some extra work requirements for food aid programmes for poor Americans. For instance, it would limit food stamp eligibility for able-bodied adults up to age 54, but Biden was able to secure waivers for veterans and the homeless.

The deal will avert an economically destabilising default, so long as Biden and McCarthy succeed in passing it through the narrowly divided Congress before the treasury department runs short of money to cover all of its obligations.

Mike Hanna, reporting from Washington, DC, said a “long way” remained before the deal can clear the House, with a 222-213 Republican majority, and the Senate, with a 51-49 Democrat majority.

“Many conservative Republicans would see the cuts as too modest, while many progressive Democrats would see them as too stringent. So there are going to be Republicans and Democrats who rebel against this,” he said.

“There’s going to be days of wrangling to get all parties on board, to get enough votes combining Republicans and Democrats to pass this legislation and send it to the president to get it signed into law,” he added.

The debt ceiling talks took so long in part because the Biden administration resisted for months negotiating with McCarthy, arguing that the country’s full faith and credit should not be used as leverage to extract other partisan priorities.

Republicans had pushed for steep cuts to spending and other conditions, saying they want to slow the growth of the national debt, which is now roughly equal to the annual output of the country’s economy.

Democrats, meanwhile, accused Republicans of playing a dangerous game of brinkmanship with the economy.

Two-way negotiations between Biden and McCarthy only began in earnest on May 16.

The long standoff alarmed financial markets, weighing on stocks and forcing the US to pay record-high interest rates in some bond sales. A default would take a far heavier toll, economists say, by likely pushing the nation into recession, shaking the world economy and leading to a spike in unemployment.

The last time the nation got this close to default was in 2011 when Washington also had a Democratic president and Senate and a Republican-led House.

Congress eventually averted a default, but the economy endured heavy shocks, including the first-ever downgrade of the US’ top-tier credit rating and a major stock sell-off.