BUSINESS

-

Nov- 2025 -7 November

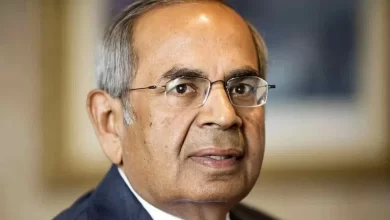

Hinduja Group chairman Gopichand Hinduja passes away in London at 85

Gopichand P. Hinduja, chairman of the global Hinduja Group and one of India’s most influential business figures, passed away in London at 85. Fondly called ‘GP’, he had been unwell for several weeks. He is survived by his wife and children New Delhi: Hinduja Group Chairman Gopichand P. Hinduja passed away in a London hospital on Tuesday. He was 85. Known as GP in business circles, he took over as Chairman of the Hinduja Group following the death of his elder brother Srichand in May 2023. He is survived by his wife, Sunita, sons Sanjay and Dheeraj, and daughter, Rita. The 2025 edition of the Sunday Times Rich List recently ranked Gopichand Hinduja’s family the richest in the UK with a…

Read More » -

7 November

Adani Enterprises Q2 net profit surges 84 per cent to Rs 3,199 crore

Adani Enterprises Ltd reported an 84 per cent surge in Q2 net profit to Rs 3,199 crore, driven by strong performance across its infrastructure and energy businesses. The company also announced a Rs 25,000 crore rights issue to strengthen its balance sheet. Ahmedabad: Adani Enterprises Ltd (AEL), the flagship company of the Adani Group, on Tuesday reported robust results for the July-September quarter and the first six months of the current fiscal (FY26), clocking an impressive 84 per cent increase in Q2 net profit at Rs 3,199 crore. The AEL Board approved a partly paid-up rights issue of Rs 25,000 crore for strengthening its balance sheet further to support the next phase of incubation. Consolidated EBITDA stood at Rs 7,688 crore…

Read More » -

7 November

Gold prices fall as strong dollar, fading Fed rate cut hopes weigh on demand

Gold prices slipped on Tuesday as a stronger US dollar and waning expectations of further Fed rate cuts prompted investors to book profits. Analysts cited easing US-China tensions and China’s new tax policy as added pressure on bullion demand New Delhi: The price of gold futures declined on Tuesday as investors booked profits, tracking gains from a stronger US dollar and lowered expectations for additional Federal Reserve rate cuts this year. The price of 10 grams of 24-carat gold was Rs 1,19,916 as of 12.30 pm, according to data published by the India Bullion and Jewellers Association (IBJA). December gold futures on the Multi Commodity Exchange (MCX) fell by Rs 836, or 0.69 per cent, to Rs 1,20,573 per 10 grams,…

Read More » -

7 November

Gold slips below USD 4,000 as dollar strengthens, trade tensions ease

Gold prices dipped below USD 4,000 per ounce, falling 2.7 per cent from last week as easing US-China tensions and a stronger dollar weighed on demand. Despite the decline, gold remains over 50 per cent higher year-to-date, supported by central bank buying Mumbai: Spot gold prices slipped below the $4,000 per ounce after a significant increase this year, dipping 2.7 per cent from last week to $3,984.43 an ounce, data showed on Monday. The price of 10 grams of 24-carat gold was Rs 1,21,113 during the day trade, according to data published by the India Bullion and Jewellers Association (IBJA). Analysts said the moderation in demand came as trade tensions between the US and China cooled and the dollar index jumped…

Read More » -

6 November

ED seizes Anil Ambani-linked assets worth Rs 3,084 crore in PMLA probe

The Enforcement Directorate has attached assets worth Rs 3,084 crore linked to Anil Ambani, his group companies, and related entities under the PMLA in a money laundering probe involving alleged diversion of public funds and loan irregularities exceeding Rs 17,000 crore New Delhi: The Enforcement Directorate (ED) has attached assets worth more than Rs 3,000 crore linked to Reliance Group Chairman Anil Ambani, his group companies, and linked entities as part of a money laundering investigation, official sources said on Monday. The federal probe agency issued four provisional orders under the Prevention of Money Laundering Act (PMLA) on October 31 for attaching the properties, including the 66-year-old Ambani’s family home in Pali Hill, Mumbai, apart from other residential and commercial properties…

Read More » -

6 November

Sensex, Nifty decline amid profit-taking, FII outflows

Equity benchmarks Sensex and Nifty fell in early trade on Monday due to profit-taking and foreign fund outflows. Analysts said FIIs booking profits and reallocating to other markets capped gains despite strong October performance. Mumbai: Benchmark indices Sensex and Nifty declined in early trade on Monday, amid profit-taking and foreign fund outflows. The 30-share BSE Sensex declined 261.39 points to 83,677.32 in early trade. The 50-share NSE Nifty dropped 62.9 points to 25,659.20. From the Sensex firms, Maruti, Bharat Electronics, Titan, Eternal, Bajaj Finance and Bajaj Finserv were the major laggards. However, Mahindra & Mahindra and State Bank of India were the gainers. Foreign Institutional Investors (FIIs) offloaded equities worth Rs 6,769.34 crore on Friday, while Domestic Institutional Investors (DIIs) bought stocks worth Rs…

Read More » -

6 November

Rupee falls 7 paise to 88.77 against US dollar in early trade

The rupee weakened 7 paise to 88.77 against the dollar on Monday, pressured by rising crude oil prices, foreign fund outflows, and weak equities, even as the dollar eased. Forex reserves and fiscal data also signalled economic pressure. Mumbai: The rupee fell 7 paise to 88.77 against the dollar in early trade on Monday, weighed down by higher crude oil prices and continuous outflow of foreign capital amid uncertainties over global trade. According to forex traders, negative sentiment in domestic equities also pressured the Indian currency, even though a weak American currency provided some cushion at a lower level. At the interbank foreign exchange, the rupee opened at 88.73 and slipped further to trade at 88.77 against the greenback, down 7 paise from…

Read More » -

6 November

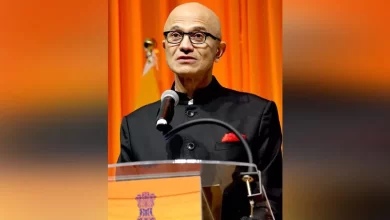

Microsoft to resume hiring with focus on AI after major layoffs, says Satya Nadella

After multiple rounds of layoffs, Microsoft plans to grow its workforce again with a focus on artificial intelligence. CEO Satya Nadella said the company will pursue “targeted scaling,” using AI to enhance productivity and empower smaller team New Delhi: After a year of major layoffs, Microsoft is preparing to grow its workforce again — but this time with a clear focus on artificial intelligence (AI). Speaking on the BG2 podcast with investor Brad Gerstner, Microsoft CEO Satya Nadella said the company’s employee count will increase in a “smarter and more leveraged” way, driven by AI technology. “We will grow our headcount,” Nadella said, adding that future hiring will be shaped by how AI boosts productivity across the company. Microsoft had about…

Read More » -

5 November

98.37 per cent of Rs 2,000 notes returned to banks, says RBI

According to RBI data, Rs 2,000 denomination banknotes worth Rs 5,817 crore remain in circulation. Since their withdrawal announcement in May 2023, 98.37 per cent of the notes have been returned. The Rs 2,000 notes continue to be legal tender, the RBI clarified. Mumbai: The high-value Rs 2,000 notes worth Rs 5,817 crore are still in circulation, according to the Reserve Bank data released on Saturday. The Reserve Bank of India (RBI) had announced the withdrawal of Rs 2,000 denomination banknotes from circulation on May 19, 2023. Rs 2,000 banknotes continue to be legal tender. In a statement, the central bank said the total value of Rs 2,000 banknotes in circulation, which was Rs 3.56 lakh crore at the close of…

Read More » -

5 November

GST collections rise 4.6 per cent in October to Rs 1.96 lakh crore amid festive buying

Gross GST collection rose 4.6 per cent year-on-year to Rs 1.96 lakh crore in October, driven by festive season demand despite rate cuts on 375 items. Domestic GST revenue grew 2 per cent, while imports contributed a 13 per cent surge in tax inflow New Delhi: Gross GST collection increased 4.6 per cent to about Rs 1.96 lakh crore in October, driven by a festive buying spree despite a cut in GST rates. Goods and Services Tax (GST) rates on 375 items, including kitchen staples to electronics and automobiles, were slashed with effect from September 22– the first day of Navratri and considered auspicious for buying new goods. The October GST collection number reflects the impact of festive season sales and…

Read More »