BUSINESS

-

Nov- 2025 -2 November

Rupee slips 21 paise to 88.43 against dollar as Fed signals no December rate cut

The rupee fell 21 paise to 88.43 against the US dollar on Thursday amid a stronger greenback after Fed Chair Jerome Powell said a December rate cut is not certain. Weak equities and FII outflows added to the pressure. Mumbai: The rupee depreciated 21 paise to 88.43 against the dollar in early trade on Thursday, weighed down by the strength of the American currency after Fed Chairman Jerome Powell indicated that the rate cut in December is not given. Forex traders said the dollar index rose to 99.05 and the 10-year yield to 4.07 per cent despite the 25 bps rate cut by the FED overnight. At the interbank foreign exchange, the rupee opened at 88.37 against the US dollar before dropping to…

Read More » -

2 November

Gold, silver prices slip on MCX after Fed’s 25 bps rate cut

Gold and silver prices tumbled on MCX after the US Fed’s 25 bps rate cut, with gold down 1.51% and silver 0.97%. Caution over future rate cuts and easing safe-haven demand weighed on prices. Mumbai: Gold and silver prices opened sharply lower on Thursday on the Multi Commodity Exchange (MCX) after the US Federal Reserve announced a 25-basis points rate cut. The decline in precious metal prices came as investors assessed the Fed’s cautious stance on future rate cuts. Gold futures on the MCX opened 1.27 per cent lower at Rs 1,19,125 per 10 grams, compared to the previous close of Rs 1,20,666. Silver prices also dropped, opening 0.4 per cent lower at Rs 1,45,498 per kilogram, against the previous close…

Read More » -

2 November

Central Bank of India CEO Kalyan Kumar highlights loan rebalancing at Hyderabad townhall

Central Bank of India MD and CEO Kalyan Kumar addressed staff in Hyderabad, urging a strategic shift in the bank’s loan portfolio from retail and MSME sectors towards corporate lending. He highlighted the impact of repo-linked loans on net interest margins, which have declined over the past year. Hyderabad: The MD and CEO of the Central Bank of India Kalyan Kumar interacted with the bank staff in Hyderabad in a townhall meeting on Wednesday. During his address to the staff, Kalyan Kumar exhorted the staff to rebalance the bank’s loan portfolio, which is currently focussed on retail, agriculture and MSME (RAM) advances, by stepping up corporate lending. The present loan composition with about 60 percent of loans are linked to the…

Read More » -

2 November

SBI Mutual Fund invests Rs 100 cr in Lenskart in pre-IPO round

SBI Mutual Fund has invested Rs 100 crore in Lenskart ahead of its Rs 7,278-crore IPO opening October 31. The pre-IPO deal slightly reduces promoter Neha Bansal’s stake, adding to recent investments as the eyewear firm prepares for a November 10 market debut New Delhi: SBI Mutual Fund has invested Rs 100 crore in eyewear retailer Lenskart Solutions in a pre-IPO (initial public offering) funding round. As part of the transaction, Neha Bansal, one of the promoters, transferred 24.87 lakh equity shares at Rs 402 apiece to SBI Optimal Equity Fund (AIF) and SBI Emergent Fund AIF, Lenskart said in a public announcement on Wednesday. After the transaction, Bansal’s stake in the eyewear firm would come down to 7.46 per cent…

Read More » -

2 November

SEBI plans big overhaul in mutual fund rules to cut costs and boost transparency

SEBI has proposed significant reforms to mutual fund cost structures, including steep caps on brokerage fees, clearer TER disclosures separating taxes, optional performance-linked fees, and shifting NFO expenses to AMCs, aiming to boost transparency and investor benefits Mumbai: The Securities and Exchange Board of India (SEBI) has proposed major changes to the way mutual funds are managed in the country. The market regulator aims to lower brokerage costs, make fee disclosures clearer, and simplify how investors are charged. In a new consultation paper reviewing the 1996 Mutual Fund Regulations, SEBI has suggested tightening the cost structures for Asset Management Companies (AMCs) so that more benefits reach investors directly. One of the biggest proposals is a sharp cut in brokerage and transaction costs…

Read More » -

1 November

Rupee trades in narrow range against dollar amid month-end demand

The rupee traded in a narrow range against the US dollar on Wednesday as support from firm domestic equities was offset by month-end demand. Traders said RBI interventions and global central bank meetings kept the currency’s movement range-bound. Mumbai: The rupee traded in a narrow range against the US dollar in early trade on Wednesday, as the support from positive domestic equities was negated by month-end dollar demand. Forex traders said the main factors influencing the rupee are geopolitical developments. Moreover, the Reserve Bank of India has also been intervening on both the buy and sell sides to keep the rupee within a range of 87.50 to 88.50, they said. At the interbank foreign exchange market, the rupee opened at 88.21,…

Read More » -

1 November

Stock markets rebound in early trade on US Fed rate cut hopes, fresh foreign fund inflows

Sensex and Nifty rebounded in early trade, tracking global gains and expectations of a US Federal Reserve rate cut. Strong foreign fund inflows boosted market sentiment, with major Asian indices trading higher, though select domestic stocks lagged amid ongoing volatility Mumbai: Stock market benchmark indices Sensex and Nifty bounced back in early trade on Wednesday, tracking a rally in global peers, amid hopes of a rate cut by the US Federal Reserve and fresh foreign fund inflows. The 30-share BSE Sensex climbed 287.94 points to 84,916.10 in early trade. The 50-share NSE Nifty went up by 86.65 points to 26,022.85. From the Sensex firms, Asian Paints, Tata Steel, Trent, Larsen & Toubro, State Bank of India and Adani Ports were among…

Read More » -

1 November

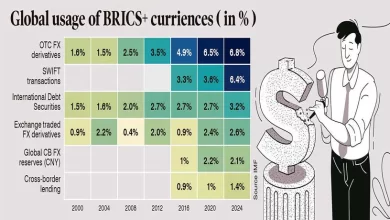

Opinion: BRICS’ quiet challenge to the dollar

BRICS nations’ push to trade in local currencies reflects frustration with dollar dominance and signals a shift in the global monetary order By Dr Jadhav Chakradhar, Prof Mini Thomas P As geopolitical tensions rise, substantial changes are quietly reshaping the world’s monetary system. A classic example is the US imposing high tariffs on several Indian products in August because of India’s oil trade with Russia. Developments like this show how politics and trade are now intricately linked, slowly changing how global finance works. For decades, the US dollar has reigned supreme as the world’s reserve currency, facilitating seamless international trade and payments. However, the BRICS bloc — Brazil, Russia, India, China, and South Africa — , which has now expanded to include…

Read More » -

Oct- 2025 -31 October

Jio registers strong growth in Telangana and Andhra Pradesh

Reliance Jio has emerged as the leading telecom operator in the AP Telecom circle, which includes Telangana and Andhra Pradesh, by adding the highest number of wireline and wireless subscribers in September 2025. Jio’s growth was fuelled by strong demand for broadband and mobile services, especially in smaller towns. Hyderabad: Reliance Jio has further consolidated its dominance in AP Telecom circle comprising Telangana and Andhra Pradesh states by posting robust growth in both wireless and wireline segments in September 2025. In the wireline subscriber base, Jio added 40,641 new users, increasing its count from 17.87 lakh in August to 18.28 lakh in September 2025, the highest among all operators. This surge reflects sustained demand for JioFiber broadband and enterprise connectivity solutions, particularly…

Read More » -

31 October

Gold tumbles Rs 4,100 in India, slips below USD 4,000 mark globally

Gold prices fell sharply by Rs 4,100 to Rs 1,21,800 per 10 grams in Delhi, slipping below the USD 4,000 mark globally as easing US-China tensions and ETF outflows reduced safe-haven demand. Silver also tumbled Rs 6,250 per kg New Delhi: Gold prices dropped by Rs 4,100 to Rs 1,21,800 per 10 grams in the national capital and slipped below USD 4,000 an ounce in the global markets on Tuesday as easing US-China trade tensions dampened safe-haven appeal. According to the All India Sarafa Association, the precious metal had closed at Rs 1,25,900 per 10 grams on Monday. In the local bullion market, gold of 99.5 per cent purity also tumbled by Rs 4,100 to Rs 1,21,200 per 10 grams (inclusive…

Read More »