Markets to take cue from earning results

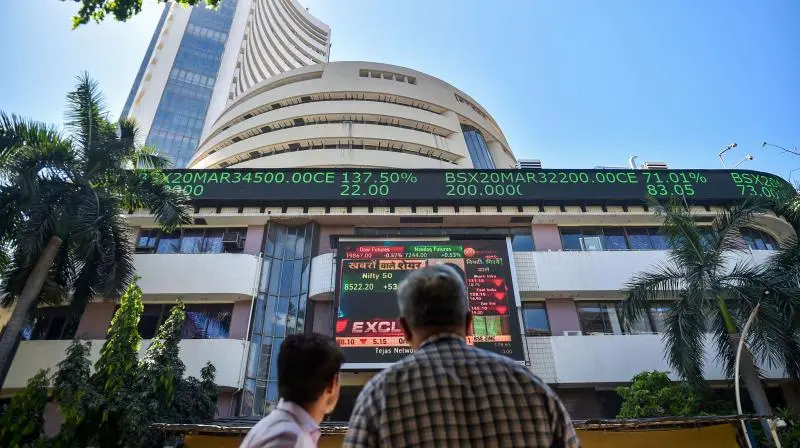

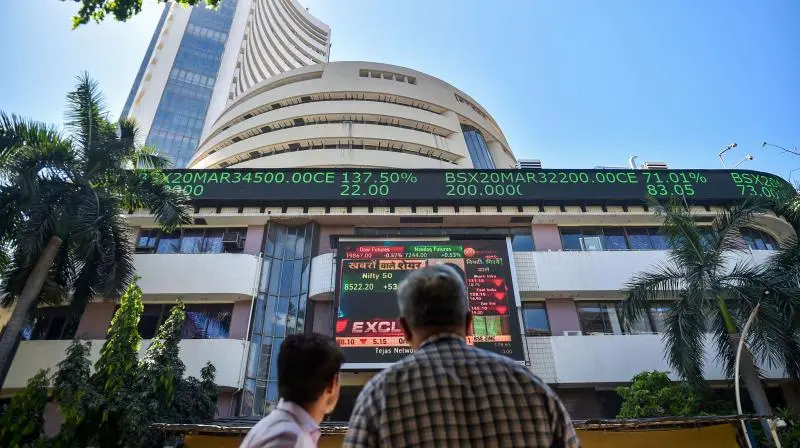

Last week, the stock markets ended on a positive note extending gains for last five sessions, with two holidays in between. PTI File Image

Mumbai: The equity market will factor in the fourth quarter earnings beginning this week. The financial results of TCS, Infosys, HDFC Bank for the fourth quarter of financial year 2022-23 will be in focus as the earnings season kicks off.

TCS will announce its fourth quarter results on April 12, Infosys on April 13, while HDFC Bank will announce its financial results on April 15, according to their filing with stock exchange.

Last week, the stock markets ended on a positive note extending gains for last five sessions, with two holidays in between.

While global cues will be in focus with China-US tension simmering on Taiwan issue, domestic factors look better placed for Indian market in form of auto sales, GST collections and a good rabi crop.

The information technology sector is expected to post muted results because of higher macro uncertainty, said analysts.

“Most indicators and our checks point to growth moderation in the near term; we expect IT sector (tier-1 IT) revenue growth to moderate,” said analysts from HDFC Securi-ties said in their preview.

The fourth quarter earnings announcement of HDFC Bank will be keenly watched as the dateline for the HDFC-HDFC Bank merger is keenly awaited by market.

After gains registered in the previous two weeks on foreign investors buying and RBI also providing much needed support to market with a rate hike pause, the stock market will be looking to add to gains from earnings announcements during the week.

Foreign portfolio investors (FPIs) have been consistent buyers in April so far — a trend that is likely to continue, said analysts.

“The basic reason for the change in FPI stance is the declining dollar index and falling bond yields in the US. The rupee has been appreciating in recent days from around 82.75 to 81.74 now,” said V.K. Vijayakumar, chief investment strategist, Geojit Financial Services.

“This trend is likely to gather momentum. FPIs have turned buyers in automobiles, financial services, capital goods, power and metals and mining. They have been selling in the technology stocks,” Vijayakumar said.