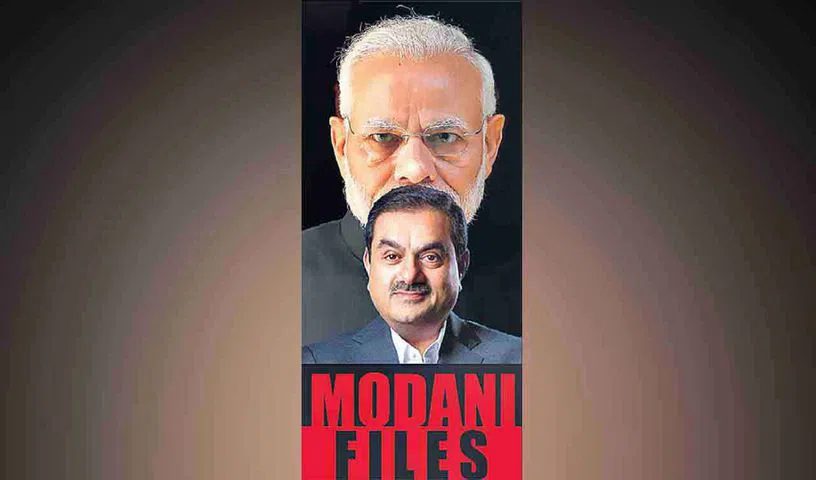

Modani Files: How LIC tread paths dreaded by private sector, all to help Adani

When the Adani Group suddenly found the ground beneath it slipping away, India’s largest life insurer stood up for the group

A couple of months ago, when the Adani Group suddenly found the ground beneath it slipping away, India’s largest life insurer stood up for the group. And it wouldn’t be too far from truth to say that the Life Insurance Corporation has been among the Adani Group’s biggest fans, particularly in the last few years. Even the sharpest of share market dealers thought twice, the LIC found it worthwhile to invest in the group.

Interestingly, this is not the first time that the troubled Adani Group has got funds from public sector undertakings, especially under Narendra Modi’s tenure.

In 2017, the Indian Oil Corporation and Gail Ltd invested in a 49-percent stake in a planned natural gas terminal valued at Rs 6,000 crore at the Adani Group-owned port of Dhamra in Odisha. This required both corporations to borrow on top of their already heavy debt burdens, according to reports. The controlling stake in the venture is with Adani Enterprises Limited (AEL), the flagship company of the Adani Group.

Indian Oil has also invested Rs.750 crore in a 50-percent stake in a Rs.5,040-crore natural gas terminal at Mundra, which was part of a joint venture between the AEL and the Gujarat State Petroleum Corporation. Such investments have helped the finances of the Adani Group at a time when the conglomerate is massively indebted.

LIC’s Helping Hand

But the LIC stands out among these. Because, when marquee investors and leading mutual funds avoided investing in the Adani Group shares altogether, LIC found it worthwhile to invest in the highly overvalued group’s shares. It invested around 4.9 times more than the sum invested by all private mutual funds put together.

Very, very unusual, ins’t it? The private sector was avoiding the group, but public sector funds were allowed to be deployed. The original total investment is around Rs.36,474.78 crore including debt.

Out of this, the investment in shares is Rs.30,127 crore. After the recent Hindenburg Research expose, the over-indebted group is in a crisis, and LIC wouldn’t be able to sell the huge quantum of shares now without incurring steep losses.

How LIC proved its faithfulness

In December 2015, LIC owned 27.9 million shares of the company when the stock was trading at Rs.84. Suddenly, between April and June 2017, it sells its entire stake in Adani Enterprises, when the stock was trading between Rs.100 and Rs.130 apiece, gaining a small profit.

Even as the question of selling off for a minor profit arose, the next three years saw nobody touching the stock. And on the other hand, foreign portfolio investors, interestingly all based in Mauritius, continued to accumulate the group’s shares.

As Hindenburg alleged, all evidence points to these being front firms of the Adani Group, which already had the most shares at 74%, with just a portion floating with the public.

And then, by December 2020, LIC returned to buy shares in Adani Enterprises starting with a few thousand at Rs 480. Even as the share price is rigged up, it kept buying in 2021 and 2022 shares to the tune of 45.8 million till September 2022 at a steep price.

In September, 22, the price reaches Rs 3,500! The transactions appear to have basically enriched the front cos by giving them such a good exit at a big profit.

Financial analysts point out that the investment did not make any sense at a price-to-earnings ratio of 200 to 374. No mutual fund worth its name would go near the stock at such a high valuation.

That was not all. Adani Total Gas was a recent listing on stock markets from November, 2018. LIC started acquiring shares in Adani Total Gas in March 2020 and now owns close to 63.5 million shares in the company, as of September 2022. Mutual funds did not invest in this company, but LIC found value in a company with a price-to-earnings ratio of 500 and more!

The friendship continued with LIC investing in three more group companies – Adani Transmission, Adani Green Energy and Adani Ports. The first two companies too never found favour with mutual funds, but LIC found it valuable at very price-to earning-ratios.

Anything for a friend!