‘No limits partnership’: Xi and Putin’s key economic priorities

Chinese and Russian leaders expected to double down on economic cooperation during three days of meetings in Moscow.

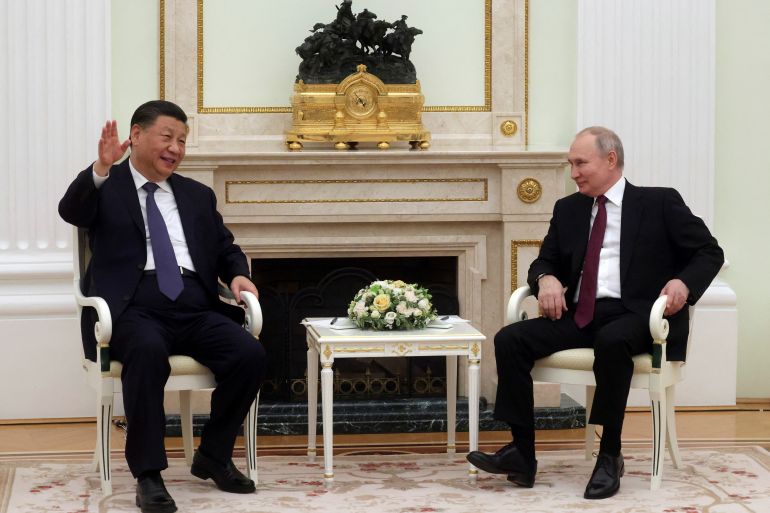

Chinese President Xi Jinping is meeting with his Russian counterpart Vladimir Putin on a three-day visit aimed at boosting Beijing-Moscow ties and cementing China’s status as a global powerbroker.

After helping to arrange a detente between Saudi Arabia and Iran earlier this month, Xi is using the trip to promote a 12-point peace plan to resolve the war in Ukraine — a proposal Putin reportedly said he views “with respect”.

With Xi’s peace plan receiving a lukewarm response in Kyiv and Washington, however, the Chinese leader is more likely to have success shoring up economic cooperation with Putin, which has deepened amid the growing isolation of Moscow.

“Xi’s trip to Russia is mainly about maintaining closer Sino-Russian relations in the post-pandemic era when both powers are experiencing hard times,” Edward Chan, a postdoctoral fellow at the Australian Centre on China in the World,.

“It is fair to expect China and Russia will have a tighter bonding economically and diplomatically,” Chan added.

Here are the key economic areas Xi and Putin are likely to focus on for greater cooperation.

Russian energy

China has emerged as a major buyer of sharply discounted Russian oil and gas as Western buyers have banned energy imports.

Russia was China’s top oil supplier in January and February at 1.94 million barrels per day, up from 1.57 million in 2022, according to Chinese customs data. Russia’s crude oil exports to China are also up, growing 8 percent in 2022 to 1.72 million barrels per day.

China’s imports of Russian pipeline gas and liquefied natural gas last year jumped 2.6 times and 2.4 times, respectively, to $3.98bn and $6.75bn.

Meanwhile, China’s imports of Russian coal surged 20 percent to 68.06 million tonnes.

The surging energy sales have provided Russia’s economy, which shrank a less-than-expected 2.1 percent last year, a much-needed lifeline in the face of sanctions. Besides China, other top buyers of Russian energy include India and Turkey, who have taken advantage of a punitive price cap on Russian oil to access cheaper energy. Analysts expect sales to continue to go up as the war in Ukraine shows no sign of ending.

Imports of Chinese goods

Shortly before Russia’s invasion of Ukraine, China and Russia announced a “no limits partnership”. Much of that has manifested in trade.

While Russia has been selling energy to China, Russia has been ramping up imports of Chinese goods, including machinery, electronics, base metals, vehicles, ships and aircraft.

China’s exports to Russia hit $76.12bn in 2022, up from $67.57bn the previous year, according to Chinese customs data.

An exodus of Western brands from Russia has been a boon for Chinese industries such as automaking, with China’s Geely Automobile Holdings, Chery Automobile and Great Wall Motor taking 17 percent of the Russian market last year.

Overall, bilateral trade between the two sides grew by nearly one-third last year to about $190bn and is likely to continue to grow. Their economic relations, however, are imbalanced.

While China is Russia’s most important economic partner, trade between the two is dwarfed by China’s trade with the Association of Southeast Asian Nations, the European Union and the United States, according to customs data. Trade between these top three trading partners in 2022 was valued at $947bn, $821bn, and $734bn, respectively, according to government data.

Ahead of his trip to Moscow, Xi published a lengthy signed letter in the Russian Gazette calling for greater economic cooperation, investment, and two-way trade.

De-dollarisation of Russia

Russia’s economy was temporarily crippled in the early days of the Ukraine invasion by Western moves to freeze the assets of Russia’s central bank and Russian commercial banks, cut off Russian financial institutions from the international payments system SWIFT, and the departure of Western banks and credit card companies.

With Russia iced out of the dollar-dominated international financial system, the Chinese yuan and cryptocurrency have stepped into the void. The share of yuan-based transactions grew from 0.4 percent to 14 percent of the total in a nine-month period, according to the Carnegie Endowment for International Peace. In September, two Russian banks began to lend in yuan and also use the currency for money transfers in lieu of SWIFT.

Russia’s growing reliance on the yuan saw the country in October become the fourth-largest offshore trading centre for the Chinese currency.

Amid dwindling dollar reserves due to sanctions, Russia’s central bank in January sold $47m worth of yuan to make up for gaps in its budget from lower oil and gas revenues.

Swapping the dollar and euro for the yuan may be an effective short-term solution, but it will make Russia more financially dependent on China, Alexandra Prokopenko, a visiting fellow at the German Council on Foreign Relations, said in a recent article for the Carnegie Endowment for International Peace.

“The de-dollarization of the economy, which the Russian authorities are so proud of, essentially translates into ‘yuanization.’ Russia is drifting toward a yuan currency zone, swapping its dollar dependence for reliance on the yuan,” Prokopenko said. “This is hardly a reliable substitution: now Russian reserves and payments will be influenced by the policies of the Chinese Communist Party and the People’s Bank of China. Should relations between the two countries deteriorate, Russia may face reserve losses and payment disruptions.”