Officials signed off on £3,000 for fine art photos for No 10, not Sunak, says Downing Street

Downing Street insisted officials rather than Rishi Sunak authorised more than £3,000 of spending on fine art photographs for the Treasury. The prime minister’s official spokesperson said: “Hotels for G20 finance ministers and central bank governors … the hotels were recommended by hosts and as such the prime minister was not involved in those decisions at all. In terms of art work in the Treasury, the PM – when chancellor – was not involved in that decision either. It was a non-ministerial decision related to refurbishment of some of the offices.”

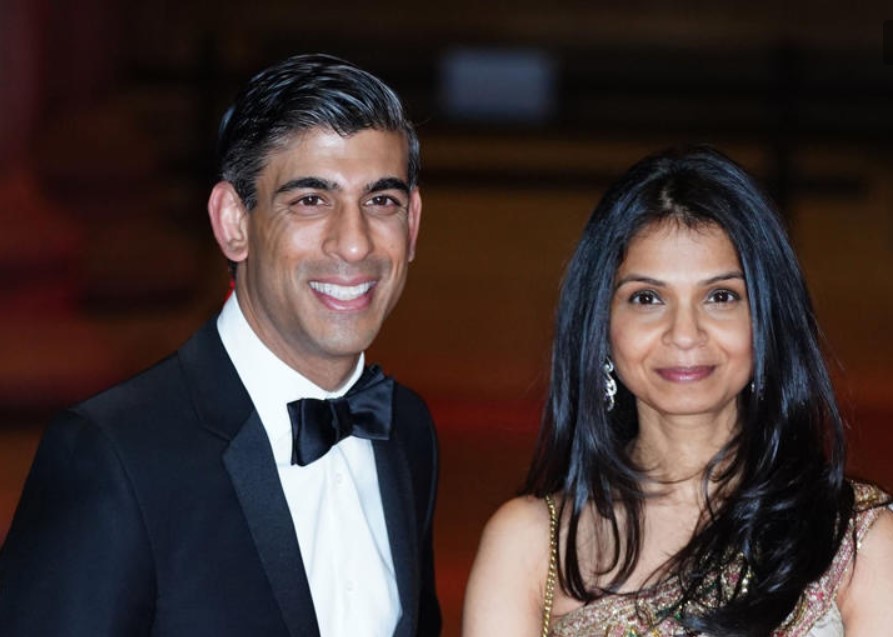

Rishi Sunak’s wife, Akshata Murty, invested in a furniture firm that received nearly £300,000 in taxpayer-funded loans handed out under policies he put in place while chancellor.

The New Craftsmen, whose upmarket range included a £7,340 mirror and a £2,220 table lamp, collapsed into liquidation in November 2022, according to Companies House filings.

The brand was sold later that month to Sarah Myerscough, a gallery owner and former company employee.

The unsecured creditors – those who are not guaranteed to receive what they are owed when a company fails – include employees who were owed £75,437, and trade and consumer creditors who were due more than £412,000.

Taxpayers also appear to have lost out in two ways, the filings suggest.

Lloyds Bank had lent The New Craftsmen £37,500 under the Covid bounce-back loan scheme introduced by Sunak in April 2020. The bank is listed among the unsecured creditors, whose claims exceed the assets in the business by £535,863.

The government also held 450,000 shares in the company via the Future Fund. The £250m investment scheme, designed by Sunak, was intended to help small startups ride out the pandemic.

Under the scheme, the government extended loans that would then convert into shares when the companies attracted new funding.

A source familiar with the loan said the government lent The New Craftsmen £250,000, a sum that was matched by private investors. The loan was converted into equity, Company House fillings suggest, the value of which has been wiped out.

As well as the government, the company’s shareholder register included several well-known wealthy investors, with the largest single stake held by Prudence MacLeod, the eldest child of Rupert Murdoch.