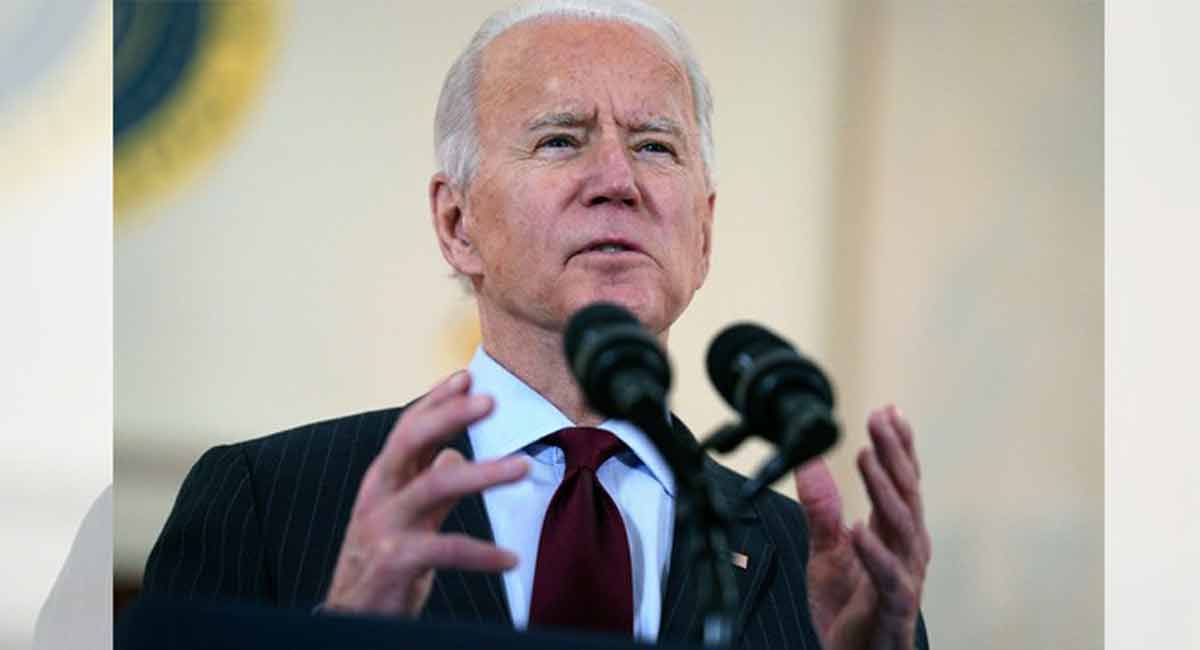

Biden plots 25pc tax on billionaires

US President Joe Biden is proposing a controversial tax grab from billionaires, rich investors and corporations in a budget request to Congress.

Mr Biden’s request, expected to be released on Thursday, calls for a 25pc minimum tax on billionaires and a doubling of the capital gains tax rate for investment from 20pc to 39.6pc.

The US President also plans to raise income levies on corporations and wealthy Americans, according to Bloomberg.

While the proposal will likely have widespread public support, it is unlikely to survive Congress, with the Republicans controlling the lower chamber.

However, it gives an insight into the Democrats’ approach ahead of negotiations over the debt ceiling and Mr Biden’s expected re-election campaign.

The President has previously failed to push through similar tax increases when the Democrats were in control of both chambers.

Under the plans, the richest 0.01pc of Americans would pay at least 25pc in taxes. They would also reverse one of Donald Trump’s cuts by raising the top rate on earners making at least $400,000 (£336,968) by 2.6 percentage points to 39.6pc.

Investors making at least $1m would be hit by the doubling tax rate. Corporation tax would also rise from 21pc to 28pc, reversing another of Mr Trump’s policies.

This would make it higher than in the UK even after Rishi Sunak’s six percentage point hike to 25pc in April.

Meanwhile, business owners and high-income individuals would no longer be able to make use of a loophole to avoid paying taxes for the Medicare Hospital Insurance Trust Fund on a larger share of their earnings.

Officials claim the plans show determination to reduce the deficit, projecting that the budget would cut $3 trillion through increased revenues over the next 10 years.

Republican House Speaker Kevin McCarthy dismissed the plans. “I do not believe raising taxes is the answer,” he told reporters.

The policy would also end lucrative tax breaks for specific sectors, affecting oil companies, crypto and real estate investors and private equity fund managers.

The overhaul would force Wall Street to come up with new ways of dealing with real estate and investment-fund deals, ditching practices that have been common for decades.

Cryptocurrency investors would not be able to sell their assets at a loss and then immediately repurchase them.