Centre’s revenue from cess, surcharges shoots up, but still no share for States

While the Centre has been claiming that the major reason for rising share of cesses and surcharges in GTR is imposition of GST Compensation Cess, States have been urging the Centre to bring them under divisible pool and share with the States.

Hyderabad: The share of cesses and surcharges in the gross tax revenue (GTR) of the union government has shot up from 8.16 percent in 2011-12 to a whopping 28.08 percent in 2021-22 under the Modi regime. While the Centre has been claiming that the major reason for rising share of cesses and surcharges in GTR is imposition of GST Compensation Cess, States have been urging the Centre to bring them under divisible pool and share with the States.

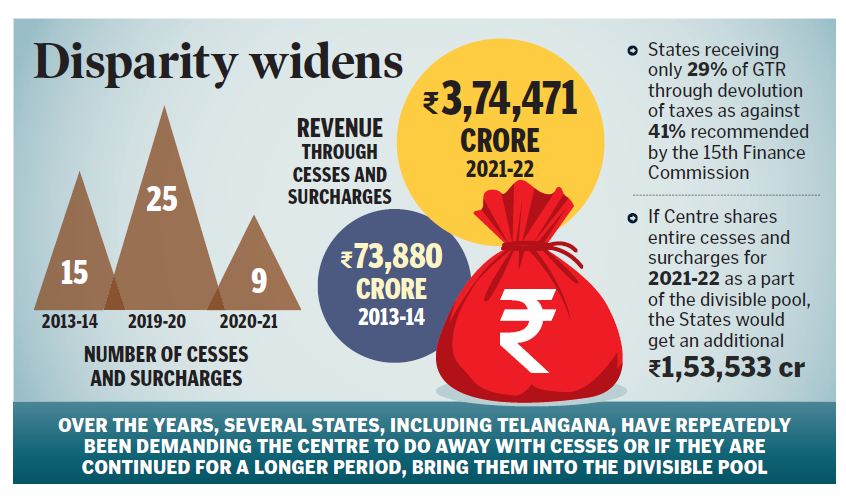

During the UPA regime, the Central government imposed 15 cesses and surcharges from 2010-11 to 2013-14. After the BJP-led NDA came to power at the Centre, the number of cesses and surcharges were increased to 25 by 2019-20. However, many of them subsumed after introduction of GST and currently, nine cesses and surcharges are being levied by the Centre. These nine cesses and surcharges account for a revenue of Rs.3,74,471 crore in 2021-22, compared to Rs.73,880 crore in 2013-14, registering a five times surge.

As per the Centre’s own admission in the Parliament, the cesses and surcharges form 28.08 per cent of the GTR of the Centre. However, as per the PRS Legislative Research study, the States’ share in the Centre’s GTR was around 29 per cent in 2020-21, due to the increase in cesses and surcharges. This is lower than the 41 percent share in Central taxes recommended by the 15th Finance Commission.

The spike in revenue through cesses and surcharges is attributed mainly to an increase in effective rate of road and infrastructure cess as additional duty of excise on motor spirit and high speed diesel oil. However, union Minister of State for Finance Pankaj Chaudhary claimed that the major reason for spike in cesses and surcharges was the imposition of GST Compensation Cess, which is entirely used for payment of compensation to States and flows to States as Grants-in-Aid, in their Receipts Budget. Resources from the other cesses are allocated to different schemes and programmes in the union Budget, which are implemented by States and other implementing agencies, he said.

Over the years, several States, including Telangana, have been repeatedly demanding that the Centre either do away with cesses or if they are continued for a longer period, bring them into the divisible pool. It may be noted that despite increased cesses and surcharges, the benefits do not flow down to the States as these are not included in the divisible pool.

Due to the Centre’s reluctance to include cesses and surcharges in the divisible pool, the States are receiving only 29 percent of GTR through devolution of taxes as against the 41 percent share recommended by the 15th Finance Commission. If the Centre shares the entire cesses and surcharges for 2021-22 as a part of the divisible pool as recommended by the Finance Commission, then the States would get an additional Rs.1,53,533 crore.