New Trouble For Adani As Deloitte Agrees With Some Of Hindenburg’s Claims Against The Conglomerate

At a time when Adani Group shares are enjoying a green phase after bleeding heavily in the first quarter of the year after Hindenburg Research’s report rattled them, fresh trouble seems to be brewing for the Gautam Adani led conglomerate.

bloomberg© Provided by Indiatimes

Audit giant Deloitte, which is Adani Ports & Special Economic Zone’s auditor, has sounded a note of caution over insufficient disclosures around the company’s transactions with certain entities. This returns the spotlight to the allegations made by short seller Hindenburg Research on Gautam Adani’s empire. For the unversed, Adani Ports is also touted as the Adani group’s ‘crown jewel’.

Deloitte Haskins & Sells LLP raised concerns this week over the Adani Group Company’s transactions with three entities, which the company said were unrelated parties. But the auditor said it couldn’t confirm that the parties were indeed unrelated and that the firm has refused to get an independent external examination that would help prove so. It therefore signed off on the company’s books only with what’s called a “qualified opinion”, as per the Bloomberg report.

Noting that “the evaluation performed by the group does not constitute sufficient appropriate audit evidence for the purpose of the audit,” Deloitte said that it can’t comment if the company was fully compliant with local laws.

3 Transactions Flagged By Deloitte

Here are more details on the three transactions flagged by audit giant Deloitte:

1. Adani Group signed an engineering contract with a subsidiary of a company identified in the Hindenburg report from whom 37.5 billion rupees ($453 million) was recoverable as of March 31st. The auditor was told by the group that this contractor is not a related party.

2. There have been financial transactions, including equity transactions, with parties identified in the short seller report. Adani Group told Deloitte that these are not related parties. All payables were settled, with no dues remaining.

3. Adani Ports’ sale of its Myanmar port to Solar Energy Ltd., incorporated in Anguilla, earlier this month. The sale price was revised from 20.15 billion rupees to just 2.47 billion rupees, and an impairment charge was taken. The group told the auditor that these are not related parties.

The management of Adani Ports,as per a Bloomberg report, recently said they had been working with the engineering contractor for a decade. They said it had been delivering projects on time and within budget, and Deloitte decided to qualify it pending the investigation by India’s capital markets regulator and Supreme Court.

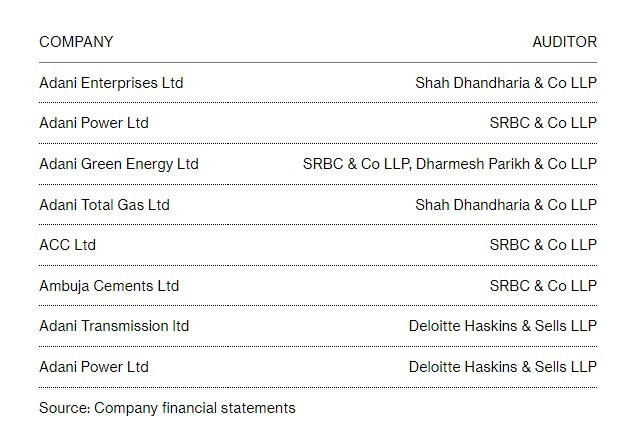

Deloitte has also issued a qualified opinion for Adani Transmission Ltd.’s financial results for the quarter through March, while auditors of other Adani Group entities — barring Adani Wilmar Ltd. and New Delhi Television Ltd.—issued similar qualified opinions on the respective financial statements, but none have specifically mentioned Hindenburg’s broadside against the conglomerate.