Noteban ghost comes back to haunt Centre

BJP-led Central government yet to accept that demonetisation had a disastrous impact on economy

Hyderabad: This is one ghost that refuses to stop haunting the Bharatiya Janata Party-led Central government.

Though the BJP was hitherto taking cover under the Supreme Court’s recent judgment upholding the November 2016 decision to demonetise currency notes of Rs 500 and Rs 1,000, the ghost of demonetisation returned to haunt the ruling party on Monday after Union Finance Minister Nirmala Sitharaman admitted in the Lok Sabha that one of the primary motives of the move, to bring about a less cash economy, was yet to be achieved.

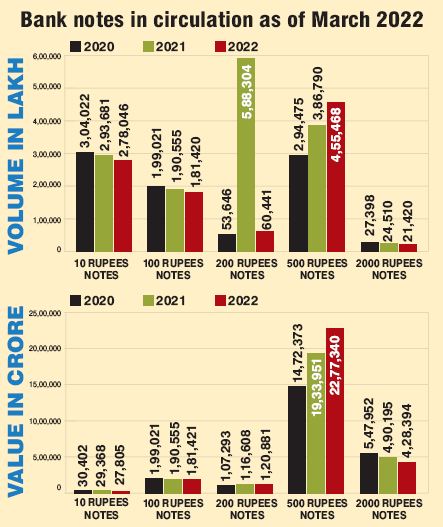

Even as the SC judgment upheld the decision, it did not conclude that the stated objectives were achieved, and that is exactly what the admission that the value of the currency in circulation had more than doubled to Rs 31.33 lakh crore also proves.

With the limelight returning to the note ban, it is pertinent to note that the Centre is yet to accept that the move had a disastrous impact, especially in the days soon after Prime Minister Narendra Modi’s now infamous speech starting with ‘Mithron…’. Though the Prime Minister claimed that his decision had helped the poor sleep peacefully but made the rich rush to medical shops to buy sleeping pills, the reality on the ground across the country was in stark contrast. It was the poor who were the most hit.

While ATMs stopped working the very next day, banks across India witnessed long queues, not of rich people, but of the common man, waiting for hours and in some cases, even for days. From daily wage workers, small and medium enterprises and to more than 90 per cent of Indians, the move spelt disaster, with later reports saying over 100 people had died in the first few weeks of the demonetisation announcement.

The victims included some who died while waiting in queues, those who were not able to find valid currency for urgent needs such as medical emergencies and weddings, those who died by suicide due to frustration of not being able to get cash and other financial constraints, and also several bank employees who were said to have died due to overwork and stress. None of the dead was the rich who had ‘rushed to medical stores’. In between, Modi kept stating different goals for the move.

From a fight against black money, he began talking about a cashless economy, which, his Finance Minister admitted on Monday, was still the government’s mission, even after six years. Apart from the DeMo ghost, there is one more thing that the BJP, and Modi, are trying hard to forget.

The Goa speech. Choking with emotion, tears welling up in his eyes, Modi asked for 50 days from the people to end their hardship. “I have asked the country for just 50 days. If after December 30, there are shortcomings in my work or there are mistakes or bad intentions found in my work, I will be prepared for the punishment that the country decides for me,” he said.

THE IMPACT OF ‘ILL-PLANNED’ MOVE

The DeMo nightmare for the country began after the Central government issued Notification No 2652 on November 8, 2016, withdrawing the legal tender status of Rs 500 and Rs 1,000 denominations issued by the RBI till November 8, 2016.

The Centre maintained that the move was necessary to tackle counterfeiting Indian banknotes, nullify black money hoarded in cash and curb funding of terrorism with fake notes. Two days later, the government allowed depositing the demonetised

notes at any bank or RBI office and obtaining value thereof by credit into their respective bank accounts.

Notes up to Rs 4,000 per person were allowed to be exchanged over the counter.

Cash withdrawals were restricted to Rs 10,000 per day subject to an overall limit of Rs 20,000 a week. ATM withdrawals were limited to Rs 2,000 per day per card and the limit later increased to Rs 4,000 per day.

The Immediate Impact: The real estate sector saw funds drying up and even weekly wages were not paid to construction labourers. Realtors in general faced fund crunch as they could not withdraw amounts required for wages due to limits on withdrawals from banks and ATMs. The obvious impact was that many cut down the workforce to match the available cash in hand.

As a result, the project executions were delayed and for homeowners, it meant more loan or rental burden. The realty sector employed roughly 45 million people in the country, with their wages accounting for 20 per cent to 30 per cent of the total project cost.

The imminent impact was that sales of residential units got affected, with sales falling by 40 per cent during October- December of 2016. This wiped out the positive trend in the remaining nine months. Various reports put the notional revenue loss due to demonetisation at an estimated Rs 22,600 crore at the country level.

The informal economy, which accounted for nearly twothirds of employment, was the worst hit. Many factories cut down the number of employees by up to 50 per cent, while many just shut the shop. There were some transactions referred to as ‘pipeline’ collections.

These included banned notes with citizens in Nepal. Initial talks between the RBI and the Nepal Rashtra Bank for the exchange of such notes did not fructify immediately. A large number of deposits also happened in the District Central Cooperative Banks before this deposit facility was withdrawn. The pipeline category also included cash seized by the Income Tax Department in raids, the amount deposited by defaulters, litigants, penalties and fines.

Demonetisation also led to money mules getting active. A lot of people from low-income groups allegedly deposited money in their accounts on behalf of a few looking to evade tax in return for a commission. Only some of these cases were tackled. The government incurred about Rs 7,965 crore in printing new notes. Normally, it would be around Rs 3,421 crore a year. In addition, there were logistics plus costs incurred by the banking system.