Pharma industry swallows ‘bitter pill’

Hyderabad: The Indian pharmaceutical sector was one of the worst-hit sectors due to the Covid pandemic. The industry faced twin shocks of raw material shortage as well as an increase in prices of primary raw material for drugs- active pharmaceutical ingredients (APIs). As the factories in China were hit by lockdown, India faced challenges to maintain continuous supply of APIs.

However, Telangana is supporting the industry by providing high incentives and strong infrastructure to cater to the global demand for APIs. Telangana, the bulk drug capital of India, accounted for 40 per cent of the country’s total bulk drug production. Telangana is home to around 800 life sciences companies and employs about 1.20 lakh people. The production mainly takes place in Hyderabad and surrounding districts of Rangareddy, Medchal, and Sangareddy, according to a report titled ‘Impact of the pharma industry on the Indian economy in the post-Covid era,’ brought out by the Federation of Indian Chambers of Commerce & Industry (Ficci) and KPMG.

As the factories in China were hit by lockdown, India faced challenges to maintain continuous supply of APIs. Nearly 70 per cent of all APIs are imported from China, the report added. China is the global leader in producing and exporting antibiotics including penicillin, cephalosporins, and macrolides. The dependence is substantial on imports, especially for antipyretics, cardiovascular, respiratory and diabetes medicines. In the case of paracetamol and a few other major antibiotics, India primarily relies 100% on imports from China.

From April-September 2021, China accounted for more than 65% of the total bulk drugs and drug intermediates imported by India. This high import dependency is due to the availability of APIs and bulk drugs in China at low prices. Any disruption in China’s bulk drugs market has a direct influence on the Indian pharma industry.

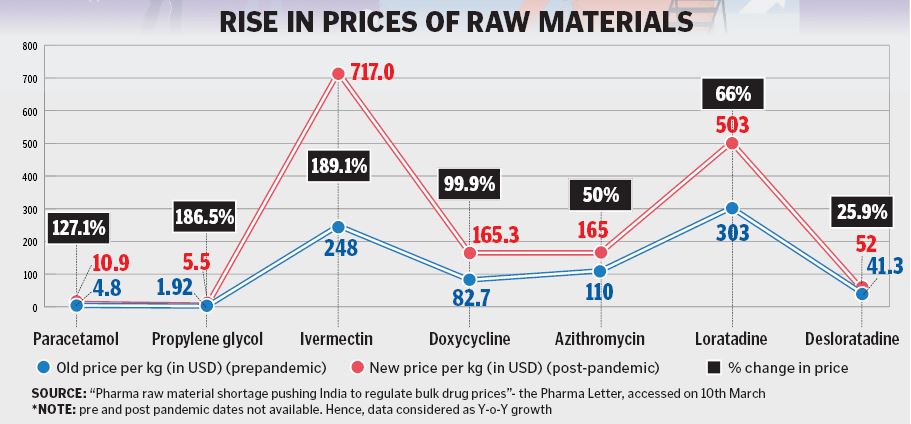

In terms of prices, APIs like paracetamol increased 127 per cent to $10.9 per kg from $4.8 earlier. Propylene glycol increased 187% (to $ 5.5 from $1.92), Ivermectin 189% (to $717 from $248), doxycycline 100% ( to $165.3 from $82.7). Prices of some of the vital drugs such as Nimesulide increased by 189 per cent, from Rs 450 to Rs 1,300 per kg between January and April 2020. Prices of 6APA, a chemical used to manufacture antibiotics, increased by more than 360 per cent, from Rs 400 to Rs 1,875 per kg.

On average, the industry was facing a price rise of around 20-700 per cent in APIs imported from China. Furthermore, pharma companies increased the prices of the products which led to a shortage of pertinent medicines. Medicines that helped to mitigate the Covid effect attained a substantially higher price, driven by the demand surge.

However, the Department of Pharmaceuticals and Drugs Controller General of India (DCGI) actively monitored the scenario and strived to tackle the raw material crisis. Efforts were made to prevent black-marketing, hoarding, and artificial shortages. The government restricted the export of around 13 APIs and their associated formulations.

The challenges with the shortage of APIs and key starting raw materials led to a shortfall in pharmaceuticals production, which impacted the country’s export of generic medicines worldwide.

Non-availability of local transportations led to retailers, wholesalers and distributors being unable to receive their consignments. Truck operators were reluctant to move due to the manhandling by police, the unavailability of food, or fuel on the run. Lockdown restrictions were not uniform and secondary transportation to stockists was also hampered, the report said.

Exports

India’s pharma exports clocked an impressive growth of over 18.2 per cent in FY21 as compared to the last fiscal. This was the highest export growth rate in the last eight years for the Indian pharma industry. The exports touched $24,469.8 million in 2020- 21 and $20,254.4 million in 2021-22 (Apr-Jan) across product categories of drug formulations and biologicals, bulk drugs and drug intermediaries, vaccines, surgicals, Ayush and herbals. The US, the UK, Russia, South Africa, and Nigeria are the top five export destinations. The US is the largest importer of Indian pharmaceuticals.

FDI

FDI in the Indian pharma sector shot up by more than 200 per cent in 2020-21. The Indian pharmaceutical industry witnessed record FDI inflows worth $1,441 million (Rs 11,015 crore) for the financial year 2020-21. The Indian medical device manufacturing industry is at the cusp of a great opportunity On account of various geopolitical reasons, global investors have begun to show a renewed interest in Indian medical devices.