This Bank Is Ready To Fund Adani’s Dream Project In Mumbai

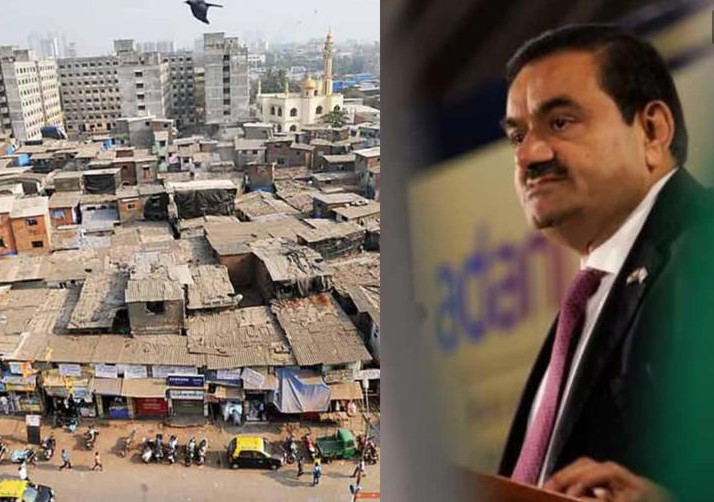

Sanjiv Chadha, the chief executive officer and managing director of Bank of Baroda, one of India’s biggest state-backed lenders, has said that the bank is willing to consider lending additional money to Gautam Adani for his ambitious Dharavi redevelopment project in Mumbai, as per Bloomberg. For those who don’t know, Dharavi is considered as one of the world’s largest slum area. Adani Group bagged the deal for Rs 5,069 crore when the Maharashtra government opened bidding in November 2022.

In an interview to Bloomberg, Sanjiv Chadha told that he’s not concerned about the market volatility around Adani stocks. “You have underwriting standards and you stick to them in good times as well as bad times,” said Chadha. However, he refused to elaborate on the bank’s total exposure to Adani’s business empire.

Several banks have had reportedly balked at refinancing Adani Group’s $500 million bridge loan that’s due next month. In a bid to boost investor sentiments, Adani Group said that it will address upcoming maturities. US-based short seller Hindenburg Research published a report on 24 January 2023, days ahead of Adani Enterprises’ public offer going live. The short-seller accused Adani Group of being overleveraged, illegal fund parking in offshore shell companies and stock manipulation.

Even though Adani Group and Gautam Adani himself vehemently refuted these allegations, conglomerate lost nearly $120 billion in market cap to date after the report was published. Adani Enterprises share was trading at Rs 1609.35, 6.58 per cent down from previous close, at the time of publication of this report.