Unable to Rein in US Dollar Sale in Hawala Markets, Pakistan Risks Being Put on FATF Grey List Again

At a time when its economy is at the tipping point, a US dollar is selling in the hawala networks and open markets of Pakistan for Rs 315 to Rs 320, even as the official bank rate is Rs 285. The Rs 30-35 gap means remittances will drop and grey markets will get stronger.

According to a Federal Investigation Agency source, if the situation continues, Pakistan’s economy will collapse at an accelerated pace. The source added that Islamabad is also unable to keep its promise to financial watchdog FATF to act on these open markets because of poor enforcement of anti-money laundering networks.

“If proper measures are not taken by Islamabad to counter grey markets and act according to its commitments to the FATF, the latter is likely to put Pakistan on the grey list and this time it would be almost impossible to get out of it,” the source said.

The country had been taken off the FATF grey list in October last year, four years after being put in the infamous categorisation.

Sources added that Pakistanis living abroad are also encouraging the grey and black markets, by skirting service charges and federal excise duties plus taxes. Many are allegedly using illegal channels to send money in and out of Pakistan for basic trade deals, and imports and exports orders.

The International Monetary Fund (IMF) is also working with Pakistan to fix its currency market and resolve other issues before it resumes its $6.7 billion bailout program that ends in June.

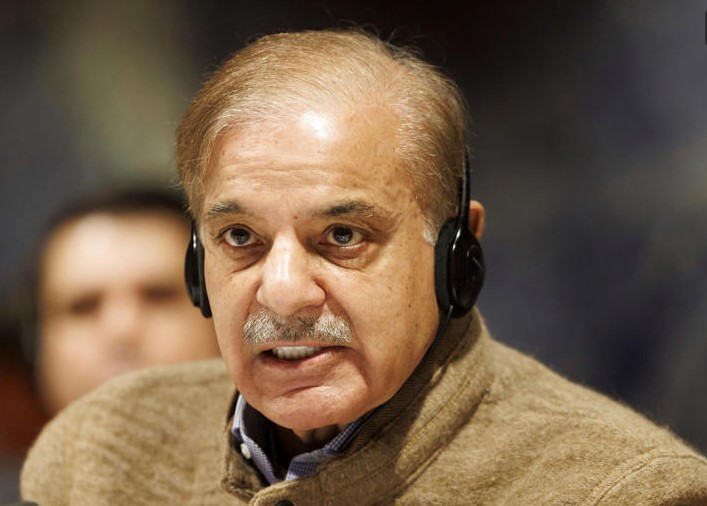

In an unusual move, the IMF on Tuesday urged Pakistan to resolve its political disputes in line with the “Constitution and rule of law”. The remarks by IMF Mission Chief to Pakistan Nathan Porter came after Prime Minister Shehbaz Sharif contacted Kristalina Georgieva, the chief of the global lender, to revive the much-awaited $6.5 billion bailout package in a last-ditch effort to avoid a possible default.

The statement didn’t go down well with Pakistan’s State Minister for Finance and Revenue Aisha Ghaus Pasha, who slammed the world body for “intervening” in Pakistan’s internal matters.

Cash-strapped Pakistan and the IMF have failed to reach a staff-level agreement on the much-needed USD 1.1 billion bailout package aimed at preventing the country from going bankrupt. The funds are part of a bailout package the IMF approved in 2019, which analysts say is critical if Pakistan is to avoid defaulting on external debt obligations. In February this year, IMF officials and the Pakistan government held discussions, which remained inconclusive.

Pakistan, currently in the throes of a major economic crisis, is grappling with high external debt, a weak local currency and dwindling foreign exchange reserves enough to shore up for barely one month’s imports.

Pakistan’s inflation level rose by a whopping 36.4 per cent in the year in April, driven mainly by food prices, the highest in South Asia, and up from 35.4 per cent in March, according to the country’s statistics bureau.